Conducting Effective ESG Due-Diligence in M&A

In the realm of Mergers and Acquisitions (M&A), the integration of Environmental, Social, and Governance (ESG) factors has emerged as a critical dimension, acknowledging the profound impact non-financial considerations have on business sustainability.

The primary objectives encompass risk mitigation, opportunity identification, compliance assurance, and value creation. A systematic methodology involves a three-pillar examination of Environmental, Social, and Governance aspects, assessing policies, practices, and performance metrics. Stakeholder engagement plays a pivotal role, emphasizing collaboration with internal and external parties for insights and concerns.

The commitment to transparency includes regular reporting channels to keep stakeholders informed. Beyond the transaction, the process involves continuous improvement strategies, reflecting an ongoing commitment to align with evolving ESG standards and industry best practices. In essence, this overview establishes the foundation for a comprehensive ESG due diligence approach, recognizing its integral role in shaping responsible and sustainable business practices.

The Multifaceted Roles of ESG Due Diligence in Business Environments

ESG DD in Investment Decision

Risk Mitigation and Long-Term Value Creation: Integrating ESG Due Diligence in investment decisions helps mitigate environmental, social, and governance risks, enhancing the resilience of the investment portfolio. Simultaneously, it facilitates the identification of opportunities aligned with sustainable practices, contributing to long-term value creation.

Alignment with Responsible Investing Principles: Incorporating ESG factors strategically aligns investment decisions with responsible and ethical business practices. This approach reflects a commitment to sustainability, resonating with the values of socially conscious investors and contributing to a positive societal impact.

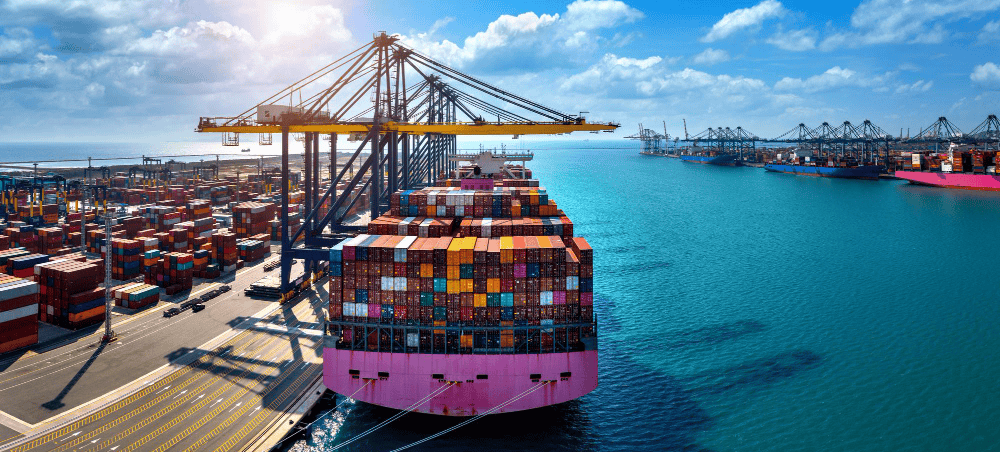

ESG DD in Supply Chain

Risk Management and Continuity Planning: Prioritize ESG considerations in the supply chain to proactively identify and manage environmental, social, and governance risks. Develop robust risk mitigation strategies and continuity plans to ensure the resilience of the supply chain against potential disruptions.

Supplier Engagement and Collaboration: Foster strong relationships with suppliers by promoting ESG principles. Collaborate with suppliers to improve environmental practices, labor conditions, and ethical standards. This not only aligns the supply chain with sustainability goals but also creates a network of responsible partners, enhancing overall ESG performance.

M&A Due Diligence Checklist

Corporate Documents/Legal Information

Financial Records

Tax Information

Sales & Marketing

Human Resources

Intellectual Property/Product Development

Technology & Operations

Employment Practices

- Types Of Due Diligence

Phase I

M&A Strategy

- Clear Objectives

- Target Identification

- Due Diligence

- Integration Planning

- Risk Mitigation

- Communication Strategy

- Financial Modeling

- Regulatory Compliance

- Talent Management

- Post-Merger Evaluation

Phase II

Target Screening

- Strategic Alignment

- Market Analysis

- Financial Assessment

- Operational Fit

- Competitive Landscape

- Due Diligence Preparation

- Cultural Compatibility

- Legal and Regulatory Compliance

- Risk Assessment

- Preliminary Valuation

Phase III

Due Diligence

Governance due diligence is a crucial aspect of the M&A process that focuses on evaluating the target company’s governance structures, practices, and compliance.

- Corporate Structure and Governance Framework

- Regulatory Compliance

- Board and Executive Leadership Review

- Ethical and Integrity Standards

- Risk Management Practices

- Financial Controls and Reporting

- Shareholder Relations

Phase IV

Transaction Execution

- Negotiation and Agreement

- Due Diligence Completion

- Regulatory Approvals

- Financing Arrangements

- Legal Documentation and Contracts

- Employee Transition Planning

- Closing Preparations

- Final Board and Shareholder Approval

- Transition Management

- Communication Strategy

Phase V

Integration

Integration refers to the process of combining two or more organizations after a merger or acquisition, aiming for a harmonized and efficient operation.

- Strategic Alignment

- Cross-Functional Teams

- Cultural Integration

- Technology Integration

- Employee Retention and Communication

- Customer and Supplier Integration

- Operational Synergies

- Performance Metrics and Monitoring

- Regulatory Compliance

- Post-Integration Evaluation